By Kesaobaka Pelokgale

As a small business owner, accounting can be a daunting task. It was personally one of my least favorite subjects before I pursued my finance degree, which is why I understand how mentally straining one might believe it is at first thought. However, it is crucial to understand basic accounting principles to ensure your business’s financial success. The truth is that most business owners are reluctant to learn these basic principles and often do not see the point. Before we begin let us understand why it is imperative for every small business owner to know their basic accounting principles.

- Financial decision-making: As a business owner, you need to make informed financial decisions. Understanding accounting principles will help you read financial statements accurately, track cash flow, and budget effectively. This will enable you to make decisions that are in the best interest of your business.

- Compliance: Businesses are required by law to keep accurate financial records and report them to the government. By understanding accounting principles, you can ensure that your financial statements are compliant with regulations and avoid legal issues.

- Communication: Understanding accounting principles also helps you communicate effectively with your accountant, financial advisors, and investors. You can discuss financial reports and budgets with them more efficiently, ensuring everyone is on the same page.

- Growth: As your business grows, accounting becomes more complex. Understanding basic accounting principles will help you manage your finances effectively, enabling you to grow your business with confidence.

- Financial control: Finally, understanding accounting principles gives you greater control over your finances. You can identify potential issues, track expenses and revenue, and ensure that you are meeting your financial goals.

Understanding basic accounting principles is essential for the financial success of your business. By keeping accurate financial records and understanding your financial statements, you can make informed decisions and manage your finances more effectively, which leads us to the issue at hand. Here are the few basic principles a small business owner has to know

The Accounting Equation

The accounting equation is the foundation of accounting. It is a simple equation that represents the relationship between assets, liabilities, and equity. The equation is Assets = Liabilities + Equity. This means that the value of all assets in a business must be equal to the sum of its liabilities and equity.

Accrual Accounting

Accrual accounting is a method of accounting that recognizes revenue and expenses when they are earned or incurred, regardless of when the cash is received or paid. This means that revenue is recognized when a sale is made, and an expense is recognized when a purchase is made, even if the cash has not yet been exchanged.

Cash Accounting

Cash accounting is a method of accounting that recognizes revenue and expenses only when cash is exchanged. This means that revenue is recognized when cash is received, and expenses are recognized when cash is paid.

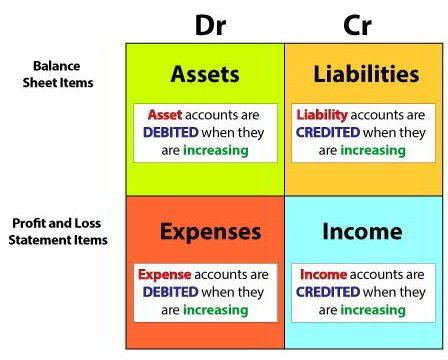

Double-Entry Accounting

Double-entry accounting is a method of accounting that records every financial transaction in two accounts – a debit and a credit account. This ensures that the accounting equation remains in balance.

GAAP

GAAP (Generally Accepted Accounting Principles) is a set of accounting standards and guidelines that must be followed when preparing financial statements. These standards ensure that financial statements are consistent, accurate, and reliable.

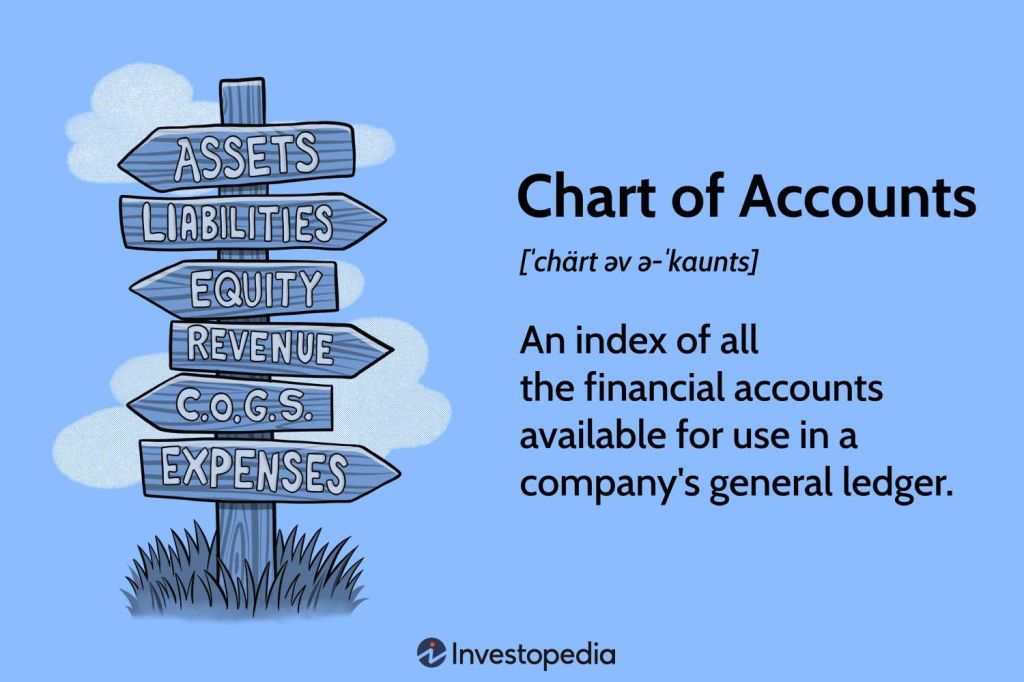

Chart of Accounts

A chart of accounts is a list of all the accounts that a business uses to record its financial transactions. This includes assets, liabilities, equity, revenue, and expenses. It is essential to have a well-organized chart of accounts to ensure that financial statements are accurate and easy to understand.

Financial Statements

Financial statements are a summary of a business’s financial transactions. They include an income statement, balance sheet, and cash flow statement. These statements provide insight into a business’s financial health and are essential for decision-making.

Budgeting

Budgeting is the process of creating a financial plan for a business. It involves setting financial goals and developing a plan to achieve them. A budget can help a small business owner manage cash flow, plan for growth, and make informed decisions.

It goes without saying that understanding basic accounting principles is essential for small business owners. By following these principles, you can ensure that your financial records are accurate, reliable, and easy to understand. This will help you make informed decisions and achieve financial success.

Never been an accounts fan either. Thank you for the eye opener. Definitely diving deeper

LikeLiked by 1 person

You are welcome, You should really. One day your business will be massive and the knowledge you can get from your deep dive will be enough for you to handle the pressure that comes

LikeLike