By Kesaobaka Pelokgale

Taxation is an essential aspect of any modern economy, and Botswana is no exception. Located in Southern Africa, Botswana has a relatively small population of less than 3 million people but boasts a vibrant economy and a stable political climate. The government relies heavily on taxation to fund its operations and to support its economic development programs. In this article, we will explore the tax system in Botswana, including its structure, rates, and exemptions.

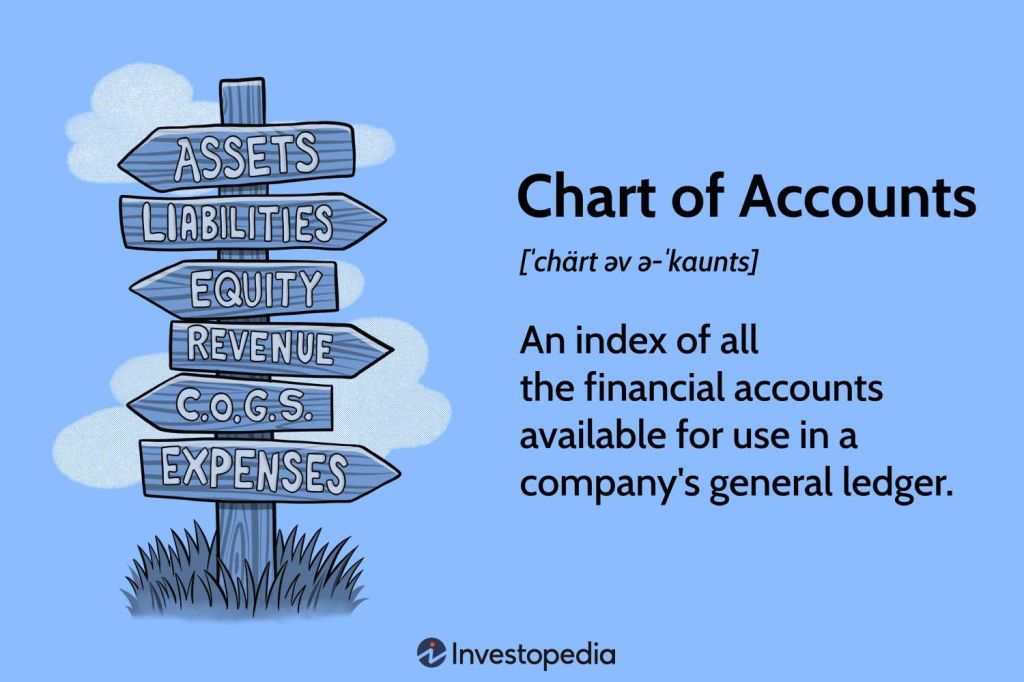

The tax system in Botswana is relatively simple and straightforward. It is administered by the Botswana Unified Revenue Service (BURS), which is responsible for collecting taxes on behalf of the government. The main taxes collected in Botswana are income tax, value-added tax (VAT), customs and excise duties, and property tax.

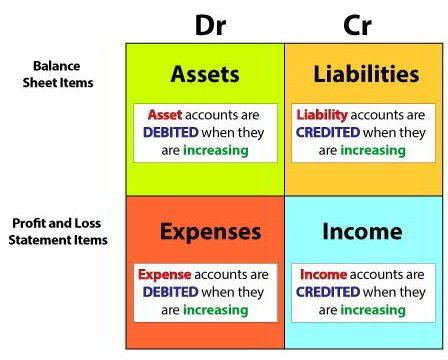

Income Tax:

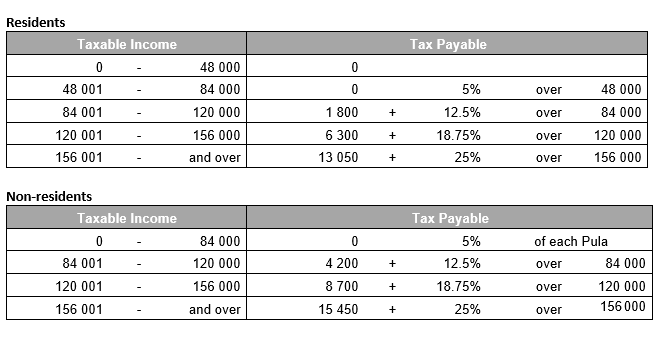

Income tax is the most significant source of revenue for the Botswana government. It is levied on the income of individuals, companies, and trusts. The tax rate for individuals is progressive. A progressive tax is a tax in which the tax rate increases as the taxable amount increases. It ranges from 5% to 25% depending on the level of income. The tax rate for companies is a flat rate of 22%, while the tax rate for trusts is 25%.

VAT:

VAT is a tax on the value added to goods and services at each stage of production and distribution. The current VAT rate in Botswana is 12%, and it applies to most goods and services, including imports.

Customs and Excise Duties:

Customs and excise duties are taxes levied on imported goods and some locally manufactured goods. The duties are charged based on the value of the goods, and the rates vary depending on the type of goods being imported or manufactured.

Property Tax:

Property tax is a tax on the value of property, including land and buildings. The tax rate is set at 0.1% of the property’s value, and it is payable annually.

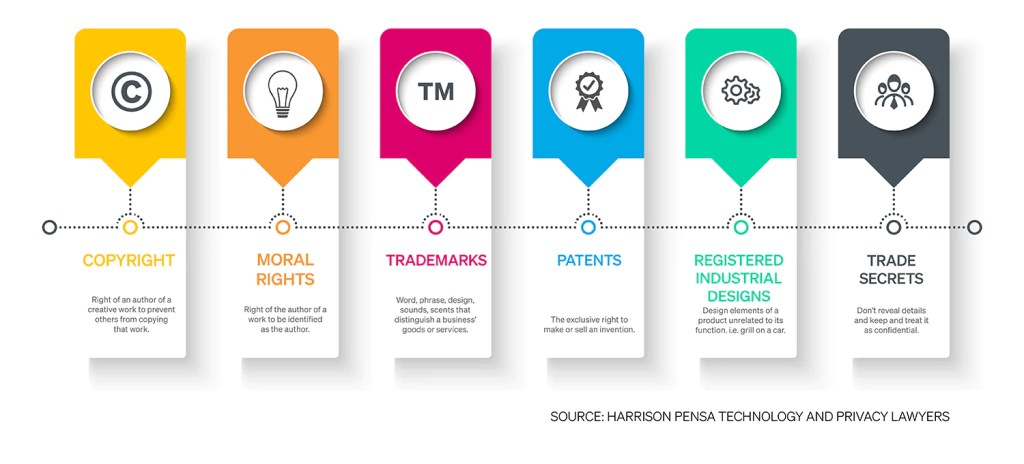

Tax Exemption in Botswana

In addition to the taxes mentioned above, Botswana also has a number of tax exemptions and incentives designed to encourage investment and economic growth. Tax exemptions are specific provisions in tax laws that allow certain individuals, organizations, or activities to avoid paying taxes on certain types of income or transactions. In other words, a tax exemption is a type of tax relief that reduces the tax liability of a taxpayer or entity. Tax exemptions can be granted for various reasons, such as to promote social welfare, to incentivize specific economic activities, or to provide relief for certain types of income earners. These include:

- Income tax exemptions: Certain types of income are exempt from personal income tax, such as income earned from agricultural activities, income earned by charitable organizations etc

- Value Added Tax (VAT) exemptions: Certain goods and services are exempt from VAT, including basic foodstuffs, medical supplies, education and training, and exports.

- Corporate tax exemptions: Certain companies, such as those involved in manufacturing, mining, or tourism, may be eligible for corporate tax exemptions or reduced tax rates.

- Capital gains tax exemptions: Capital gains tax is not charged on the sale of a principal residence or shares in a public company listed on the Botswana Stock Exchange.

- Dividend tax exemptions: Dividends paid by Botswana-resident companies to other Botswana-resident companies are exempt from tax.

It is important to note that eligibility for tax exemptions may be subject to certain conditions or requirements. It is recommended that individuals and organizations consult with a tax professional or the Botswana Unified Revenue Service for further information on tax exemptions in Botswana.

Special economic zones that offer tax incentives and other benefits to investors who set up businesses in designated areas.The mandate of the Special Economic Zones Authority (SEZA) in Botswana is to establish and manage Special Economic Zones (SEZs) in order to promote economic growth, attract foreign investment, and create employment opportunities.

Overall, the tax system in Botswana is relatively simple and straightforward, with a low tax burden compared to many other countries. The government’s focus on attracting foreign investment and promoting economic growth has resulted in a tax system that is designed to encourage business and support development.

While there may be some room for improvement, particularly in terms of reducing the administrative burden on taxpayers, Botswana’s tax system is generally seen as effective and efficient.

Kindly feel free to leave your thoughts below..,…