By Kesaobaka Pelokgale

Investing in the stock market can be an effective way to grow your wealth over the long term, and the Botswana Stock Exchange (BSE) offers investors an opportunity to invest in a diverse range of companies operating in Botswana. This guide will provide an overview of how to invest in the BSE and some key considerations to keep in mind.

Get familiar with the BSE

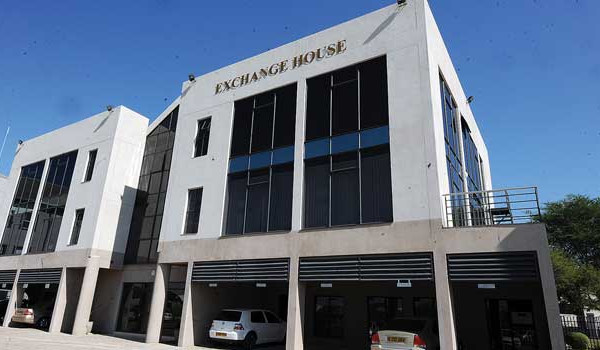

Before investing in the BSE, it’s important to understand how it works. The Botswana Stock Exchange (BSE) is the primary securities exchange of Botswana, located in the capital city of Gaborone. The BSE was established in 1989 and it is regulated by the Non-Bank Financial Institutions Regulatory Authority (NBFIRA), which oversees the listing, trading, and settlement of securities. It is governed by two (2) pieces of legislation, the Companies Act and the Securities Act.

The BSE operates as a self-regulatory organization, providing a platform for the trading of equities, bonds, and exchange-traded funds (ETFs) listed on the exchange. As of 2023, there are over 30 listed companies on the BSE.

The BSE is a member of the African Securities Exchanges Association (ASEA) and the World Federation of Exchanges (WFE), which facilitates collaboration and information sharing among international exchanges.

Understand the risks

Investing in the stock market always carries a certain level of risk, and the same is true for the BSE. The value of your investments can go up or down, and there’s no guarantee that you’ll make a profit. It’s important to be aware of these risks and do your own research before investing.

Open a brokerage account

To invest in the BSE, you’ll need to open a brokerage account or Central Securities Depository account (CSD) with a licensed stockbroker. There are several brokers operating in Botswana, and each has its own fee structure and account minimums. Look for a broker that fits your investment goals and budget. The four (4) licensed BSE Brokers are:

•Motswedi Securities: (+267) 3188627 motswedi@motswedi.co.bw

•African Alliance Securities Botswana: (+267) 3188958 info@africanalliance.com

•Stockbrokers Botswana: (+267) 3957900 info@sbb.bw

•Imara Capital Securities: (+267) 3188886 enquiriesbots@imara.

Choose your investments

Once you’ve opened a brokerage account, you can start investing in the BSE. You can choose to invest in individual stocks or buy shares in a mutual fund or exchange-traded fund (ETF) that tracks the BSE index. Before investing, do your research on the companies or funds you’re interested in and consider their financial health, growth potential, and management team.

Monitor your investments

Investing in the stock market is a long-term game, and it’s important to keep an eye on your investments over time. Monitor the performance of the companies or funds you’re invested in, and consider rebalancing your portfolio if necessary. Remember, investing requires patience and discipline, and it’s important to have a long-term strategy in place.

In conclusion, investing in the Botswana Stock Exchange can be a lucrative opportunity for those who are willing to do their research and take a long-term approach to investing. By understanding the risks, opening a brokerage account, choosing your investments wisely, and monitoring your portfolio, you can increase your chances of success in the BSE.

For more information the BSE, go to

Business Landing

The little information you shared my turn to do my research…. Thanks boss

LikeLike